-

Financial statements audits

Financial statements audits

-

Financial statement reviews

Financial statement reviews

-

Financial statements compilations

Financial statements compilations

-

IFRS

IFRS

-

Audit quality monitoring

Audit quality monitoring

-

Global audit technology

Global audit technology

-

Systems and risk assurance

Systems and risk assurance

-

General business consulting

General business consulting

-

Market research

Market research

-

Sustainability

Sustainability is indeed a broad concept. Aside from mitigating the environmental changes caused by the interaction of the industrial world and society with nature, social and governance matters are subjected to increased public and government scrutiny, calling for the promotion of a sustainable performance agenda.

-

Business planning and performance improvement

Business planning and performance improvement

-

Change and program management

Change and program management

-

Business intelligence and analytics

Business intelligence and analytics

-

Business valuation and litigation support

Business valuation and litigation support

-

Business process outsourcing and consulting

Business process outsourcing and consulting

-

Family business consulting

Our business solutions for family businesses center on alignment of all aspects of the family and business, including culture, vision, mission, values, governance, ownership, leadership, communication and policy development.

-

Quantitative small caps

Grant Thornton has a wide professional network with a vast array of technical skills that is coupled with a drive to understand the business problem; we can set up the most efficient financial risk management structure that fits your underlying business structure and your risk appetite.

-

Data analytics

Data analytics is the process through which businesses leverage data to gain actionable insights and enhance their performance. This is based on a solid foundation of well-organised and accurate data. Many businesses have a large amount of data at their disposal however, most of them do not have the expertise to analyse the available data.

-

Bookkeeping & financial accounting

Bookkeeping & financial accounting

-

Payroll and personnel administration

Payroll and personnel administration

-

Direct and Indirect tax compliance

Tax compliance within outsourcing

-

Compilation of financial statements

Compilation of financial statements

-

Business process outsourcing

Business process outsourcing including back office and secretarial

-

Family business consulting

Family business consulting

-

Startups

Startups

-

Company formation

Company formation

-

BOR

Entities in Malta, including companies, partnerships, foundations, trusts and associations, have an obligation to disclose the ultimate beneficial owner/s (physical person) of the entities. A beneficial owner is defined as the individual (s) who ultimately owns or controls a legal entity or arrangement through direct or indirect ownership of a sufficient percentage of the shares or voting rights or ownership interest in that entity.

-

Internal audit

Internal audit

-

Risk management and internal controls consulting

Risk management and internal controls consulting

-

Governance and risk management

Governance and risk management

-

Regulatory services

Regulatory services

-

Risk modelling services

Risk modelling services

-

Forensic and investigation

Forensic and investigation

-

Compliance audit

A compliance audit is a detailed review which focuses on whether an organisation is in conformity with statutory laws as well as internal rules and decisions. This type of audit also assesses the effectiveness of an organization’s internal controls by identifying weaknesses in compliance processes whilst finding measures to enhance such processes.

-

Citizenship by naturalisation

The Maltese Citizenship Act (Cap 188) establishes who may become a citizen of Malta by naturalisation, provided that the applicant satisfies the relative provisions.

-

Citizenship for Exceptional Services by Direct Investment

With the continuously changing global dynamics and evolving geopolitics, there is an ever-growing number of highly-talented high-net-worth individuals who are willing to invest and relocate to give themselves and their family members the chance to broaden their horizons and become part of a welcoming community.

-

Grant of Citizenship for Exceptional Services

Malta has enacted legislation which extends to individuals providing excellent or manifestly superior contributions in the fields of science, research, sports, arts and culture as well as people of exceptional interest to the Republic of Malta, the right to become Maltese citizens.

-

Acquisition of citizenship by registration

The Maltese Citizenship Act (Cap 188) establishes who can register as a citizens of Malta. The Act was amended on 1st August 2007, this making it possible for second and subsequent generations born abroad to acquire Maltese citizenship by registration.

-

Maltese Family Businesses Resource Centre

For over 30 years Grant Thornton’s advisory teams have assisted family businesses in navigating the challenges of leadership and succession across generations

-

Grooming

Preparing the next generation for leadership and ownership is an integral part of any succession process. Grant Thornton can help formulate the necessary grooming plan for all the potential successors.

-

Tax services

Using a combination of reason and instinct, we can work with clients to develop a strategy that helps them understand and manage their tax liability in a transparent and ethical way.

-

Governance

Having a proper governance structure is essential to ensure that the family and business strategies are achieved. Grant Thornton can advise on this, and facilitate the implementation of the ideal governance structure based on the exact scenario.

-

Ownership succession

Letting go of your family business is difficult for all owners and even more so for founders; however, in a family business the additional challenge presented by the family component increases the complexity of this process. Our team of family business advisors will ensure that such ownership issues are dealt with in an effective and structured approach.

-

Exit strategies

There are many 'exit strategies' that need to be considered to minimise the risk of conflict. They can arise from the eventual exit of a family member from the ownership ranks and can have many causes. See how we can help.

-

Management succession

By implementing our family business guidelines to family succession and a proper governance structure, the management succession process can be completed with minimal conflict and will result in the most competent successor being chosen.

-

Shaping Malta's Future: GenAI

Join our exclusive GenAI Design Thinking Workshop with Microsoft and industry leaders. Gain practical insights, explore real-world AI use cases, and leave with a blueprint for your next AI-driven innovation - potentially 100% funded by Microsoft!

-

DORA Consultancy

Firms within the financial sector face a critical imperative to fortify their operational resilience in the digital sphere. Get ahead & prepare for DORA!

-

Cyber security Consultancy

Whether you are a multinational corporation, a small business, or an individual, the digital realm holds equal importance for us all.

-

Digital Transformation

Build a solid foundation to fuel business reinvention and gain the flexibility you need to succeed through digital transformation.

-

IT Audit and Assurance

Information systems procedures have evolved drastically, but so have hacking techniques. Assess your IT resilience & protect your firm!

-

Fintech and Innovation

Are you ready to explore the fintech space? Grant Thornton is able to guide you from start to finish.

-

Case Studies

Digital transformation has transitioned from being an option to a necessity. The race is on... The question is, are you ready?

-

Operational and financial restructuring and reorganisation

Operational and financial restructuring and reorganisation

-

Recovery

Recovery

-

Financial regulatory services

Financial regulatory services

-

GDPR consultancy

The General Data Protection Regulations (GDPR) have transformed the way we handle personal data. This regulation is a game-changer for businesses operating within the EU, or the handling of EU citizens' data worldwide.

-

Ship and aircraft registration

Ship and aircraft registration

-

Medical cannabis licensing in Malta

A study published in 2018 by market intelligence and strategic consultancy firm Prohibition Partners, has forecasted that the European cannabis market will be valued €115.7 billion by 2028. According to the same study, while patient numbers are currently below 100,000 across the region, their number is set to grow to over 30 million in the next decade. In 2018 Malta introduced a bill to legalise the use of medical marijuana and attract companies willing to produce high-grade medical cannabis for the European market.

-

Trust and trustee services

As an entrepreneur, business owner, parent or guardian, you will want to ensure that whatever happens in the future, the rewards from your hard work can be protected as efficiently as possible. Grant Thornton Fiduciaire Limited (Grant Thornton) understands this and provides a professional and holistic trust management service.

-

Family trusts

The law establishes the requirement of a license for one to be able to act as a trustee subject to certain limited exceptions. One such exception is found in the Rules for Trustees of Family Trusts which provide for an exception to this rule where a trust is set up to hold property settled by a settlor or settlors for the present and future needs of family members or of family dependants who are clearly identifiable.

-

Programmes

Grant Thornton is authorised and regulated by the Government of Malta to handle and submit applications for both citizenship applications as well as residence permits under the various residence programmes available in terms of Maltese law.

-

Ordinary residency in Malta

Any EU, EEA or third country national who resides in Malta for more than 3 months is obliged to apply for a Residence Permit. There are various grounds upon which an applicant may apply to require a residence permit, including: Self-Sufficiency, Employment or Self-Employment, Family Members, Permanent Residence, Study Purposes.

-

Qualifying Employment in Aviation Rule

Malta provides qualified persons employed in the field of aviation with an opportunity to enjoy a 15% flat personal tax rate on income generated from their direct employment in Malta. For a candidate to qualify, their annual income must exceed €45,000. This does not include the value of fringe benefits and applies to the derived income received from an eligible office.

-

Qualifying Employment in Innovation and Creativity (Personal Tax) (Amendment) Rules, 2019

These Rules allows persons employed in a role directly engaged in carrying out, or management of research, development, design, analytical or innovation activities, to enjoy a 15% flat personal tax rate on income generated from their direct employment in Malta.

-

Qualifying Employment in Maritime and Offshore Oil & Gas Industry Rule

Malta provides qualified persons employed in the field of aviation, with an opportunity to enjoy a 15% flat personal tax rate on income generated from their direct employment in Malta.

-

Nomad Residence Permit

The NOMAD residence permit, which was launched in June 2021, allows third-country nationals who would normally require a Visa to travel to Malta, to retain their current employment based in another country whilst legally residing on the island.

-

Direct international tax

Direct international tax

-

Indirect international tax

Indirect international tax

-

Global mobility services

Global mobility services

-

Transfer pricing

Transfer pricing

-

Estate planning

Estate planning

-

Wealth advisory

Wealth advisory

-

Regulatory and legal

Regulatory and legal

-

Corporate tax services

Corporate services

-

VAT

At its simplest, VAT is a tax on consumption and is a multi-stage tax (ie applied at every stage of the production process), which is applied to both goods (ie tangible property) and services. Additionally, although the tax is ultimately borne by the consumer (by getting included in the price paid), responsibility for charging, collecting and passing the tax on to the tax authorities, rests with the supplier.

-

2018 Amendments of the Income Tax Act

The following is a brief overview of the new tax provisions introduced in 2018 by the Budget Implementation Act (Act VII of 2018) and other legislative enactments

-

Mergers and acquisitions

Mergers and acquisitions

-

ESEF Reporting

Our ESEF reporting service is tailored to assist listed companies in complying with the European Single Electronic Format (ESEF) requirements. As of 2020, ESEF is mandated for annual financial reports of issuers with securities listed on regulated markets. We provide services for mapping the taxonomy and generating audit/regulator-ready xHTML reports.

-

Prospects MTF

As of 2016, small and medium-sized enterprises in Malta can access the capital markets through Prospects - a market of the Malta Stock Exchange (MSE) designed specifically for Small and Medium sized Enterprises (SME). Prospects offers a cost-effective opportunity for entities looking to raise up to €5 million per issue.

-

Project financing

Project financing

-

Due diligence

Due diligence

-

Valuations

Valuations

-

Foreign direct investment

Foreign direct investment (FDI) is the category of international investment that echoes the objective of obtaining a lasting interest by an investor in one economy in an enterprise resident in another economy.

-

Wholesale Securities Market

WSM is a joint venture between the Malta Stock Exchange and the Irish Stock Exchange, combining the best of each partner’s processes and technical skills.

-

Aviation

The Maltese Government is constantly remaining to improve the position as the best place to do business within the aviation industry through exhaustive tax agreements, powerful legislation, and many aviation professionals. This is the best time for airlines, financiers and aircraft owners to be located in Malta.

-

Maritime

For Maritime, Grant Thornton provide direction with regards to VAT guidelines for yacht leasing, as well as ship and aircraft registration.

-

Automotive

We offer a broad range of services relating to automotive, ranging from Transaction advisory, access to finance, business advisory, process and inventory management, tax advisory, audit and advisory, outsourced support services.

-

Gaming Regulations

Malta recently overhauled the framework regulating the iGaming sector. Going forward operators will still be required to obtain authorisation to carry out regulated activities.

-

Licensing Process

Prior to submission all applicants are advised to go through a pre-application process with one of the MGA’s Licensing Officers. This will ensure that the application has been correctly compiled and all the key ingredients are present.

-

Malta Real Estate Investment Trust (REIT)

As part of the 2019 budget, the government has pledged to introduce a Real Estate Investment Trust (REIT) framework in Malta.

-

The Markets in Financial Instruments Directive (MiFID) II

MiFID II aims to protect investors and make sure that financial markets operate in the fairest and most transparent way possible. Building on stock and investment trading regulation introduced in 2007 it sets to ensure a more integrated financial market.

-

Fintech and Innovation

At Grant Thornton we help innovative firms and entities operating in the fintech space launch new propositions and grow their business. We also help established businesses transform and take advantage of the fintech revolution.

-

Asset Management

At Grant Thornton we help innovative firms and entities operating in the fintech space launch new propositions and grow their business. We also help established businesses transform and take advantage of the fintech revolution.

-

Banking

Grant Thornton combines local insight with global scale to help banks meet regulatory expectations, improve technology, and finance the right companies. If you’re looking for a partner in the banking industry, our expertise can make a difference

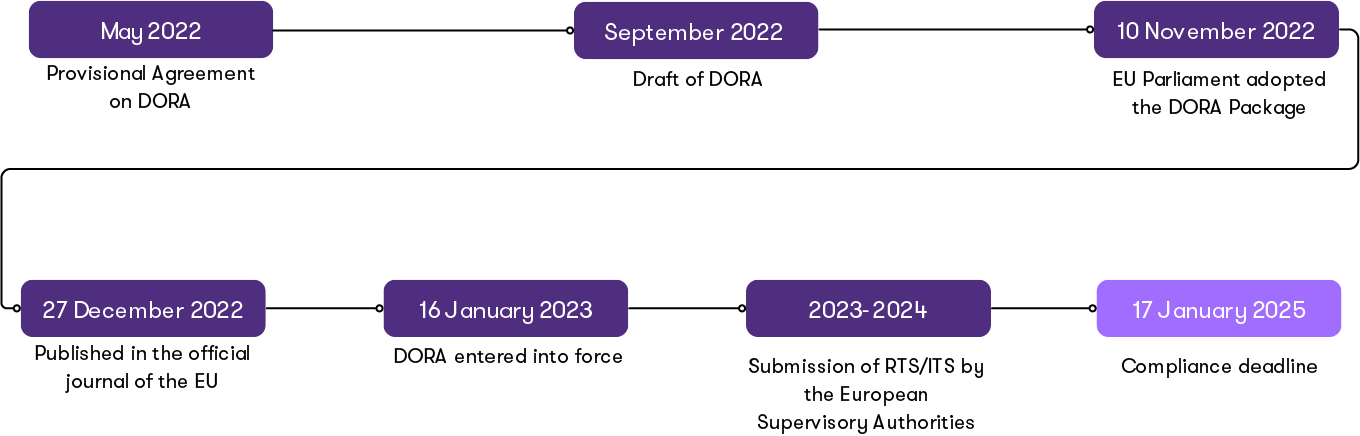

DORA, introduced by the European Commission in September 2020 as part of the Digital Finance package, is more than a mere legislative framework.

It addresses the critical need for operational resilience in the financial sector in a world where digital intricacies and financial systems are interwoven as never before.

In scope entities

The DORA act focuses on regulating the entities within the European Union’s financial sector to ensure their operational resilience in the digital age. The entities in scope for DORA primarily encompass a wide array of financial institutions, such as banks, investment firms, trading venues, credit institutions, management companies and insurance undertakings. DORA extends its reach to entities that rely heavily on information technology services, including cloud providers and third-party service providers that are integral to the functioning of financial services.

Risk based approach: The foundation of resilience

One size does not fit all. The traditional and systematic approach often struggles to adapt to changing business environments and evolving regulatory landscape. We recommend that you cultivate a risk culture and implement a risk-based approach to DORA by tailoring your resilience strategies according to your unique business operations, size and risk profile. This flexibility ensures that your organization can evolve to accommodate changes in the business environment, emerging risks, or shifts in regulatory requirements.

How we can help you

Our Solution to Mastering the DORA Compliance Journey

With the compliance deadline for the Digital Operational Resilience Act (DORA) swiftly approaching in January 2025, the urgency for companies to act has never been more pressing. GT is your trusted partner in this crucial journey. We offer tailored solutions to assess, strategise, and implement DORA compliance for your organisation, ensuring you meet the deadline and position your company for greater security, trust, and competitiveness in the digital age.

DORA's essential pillars

Based on the results of the readiness assessment, our team may offer recommendations for enhancing your operational resilience and tailoring your compliance roadmap to align with the DORA requirements.

Our services vary according to the needs and requirements of the client, which include but are not limited to: