Definition of a lease

IFRS 16 represents the first major overhaul of lease accounting in over 30 years. The new Standard will affect most companies that report under IFRS and are involved in leasing and will have a substantial impact on the financial statements of lessees of property and high-value equipment.

Since accounting for leases under IFRS 16 results in substantially all leases being recognised on a lessee’s balance sheet, the evaluation of whether a contract is (or contains) a lease becomes even more important than it is under IAS 17. In practice, the main impact will be on contracts that are not in the legal form of a lease but involve the use of a specific asset and therefore might contain a lease – such as outsourcing, contract manufacturing, transportation and power supply agreements. IFRS 16 changes the definition of a lease and provides guidance on how to apply this new definition. As a result, some contracts that do not contain a lease today will meet the definition of a lease under IFRS 16, and vice versa.

Under IFRS 16 a lease is defined as ‘a contract, or part of a contract, that conveys the right to use an asset (the underlying asset) for a period of time in exchange for consideration’. A contract can be (or contain) a lease only if the underlying asset is ‘identified’. Having the right to control the use of an identified asset means having the right to direct, and obtain all of the economic benefits from, the use of that asset. These rights must be in place for a period of time, which may also be determined by a specified amount of use.

Put simply, if the customer controls the use of an identified asset for a period of time, then the contract contains a lease. This will be the case if the customer can make the important decisions about the use of the asset in a similar way it makes decisions about the use of assets it owns outright.

In such cases, the customer (i.e. the lessee) is required to recognise these rights on its balance sheet as a ‘right-of-use’ asset. In contrast, in a service contract, the supplier controls the use of any assets used to deliver the service. Hence, there is no right-of-use asset.

Applying the new definition involves three key evaluations, all of which must be met in order to conclude that a contract is or contains a lease. These evaluations are summarised in the following flowchart:

Lease Term

Determining the correct ‘lease term’ is significant for a number of reasons. Firstly, the longer the lease term, the larger the lessee’s right-of-use asset and lease liability will be. Secondly, the length of the lease term determines whether a lease qualifies for the short-term lease exemption.

‘Lease term’ is defined as the non-cancellable period for which a lessee has the right to use an underlying asset (including any periods covered by a lessor’s termination option), plus periods covered by a lessee’s extension option if extension is reasonably certain and periods covered by a lessee’s termination option if the lessee is reasonably certain not to terminate.

While the concept of ‘reasonably certain’ has not changed from IAS 17, the application of this concept in practice requires consideration of all the facts and circumstances that create a significant economic incentive for a lessee to extend the lease (where a lessee has an extension option) or not to terminate a lease (where the lessee has a termination option). This is ultimately a judgement considering factors specific to the asset, the entity and the wider market.

In order to be considered when assessing the lease term, options to extend or terminate the lease must be enforceable. This means that when a lessee exercises its option to extend or terminate the lease, the lessor cannot have the right to decline the request. If the lessor can decline a lessee’s request to extend or terminate the lease, then the lessee’s option is not enforceable and is ignored when assessing the lease term.

Initial assessment of the lease term

Entities are required to assess a lease’s term at the lease ‘commencement date’ which is the date on which a lessor makes an underlying asset available for use by a lessee. It is important to contrast the lease commencement date with the lease ‘inception date’, which is the earlier of the date of a lease agreement and the date of commitment by both parties to the terms and conditions of the lease. A lease term begins at the commencement date and includes any rent-free periods provided to the lessee by the lessor.

Reassessment of lease term

After the commencement of the lease, the lessee must reassess whether it is reasonably certain to exercise an extension or termination option, if there is a significant event or change in circumstances that:

- Is within the lessee’s control; and

- Affects whether exercise (or non-exercise) is reasonably certain.

In principle, the IASB is of the view that regular reassessment of extension, termination and purchase options by lessees would provide more relevant and useful information to users of financial statements. However, recognising the potential costs associated with such regular reassessments, the IASB adopted a more balanced approach whereby reassessment is only required in the circumstances outlined above. However, reassessment cannot be made upon the occurrence of significant events or changes in circumstances that are not in control of the lessee.

Understanding the discount rate

Under IFRS 16 ‘Leases’, discount rates are used to determine the present value of the lease payments used to measure a lessee’s lease liability. Discount rates are also used to determine lease classification for a lessor and to measure a lessor’s net investment in a lease.

For lessees, the lease payments are required to be discounted using:

- the interest rate implicit in the lease, if that rate can be readily determined, or

- the lessee’s incremental borrowing rate.

For lessors, the discount rate will always be the interest rate implicit in the lease.

A lessee will need to determine a discount rate for virtually every lease to which it applies the lessee accounting model in IFRS 16. However, a discount rate may not need to be determined for a lease if:

- a lessee applies the recognition exemption for either a short-term or a low-value asset lease;

- all lease payments are made on (or prior to) the commencement date of the lease, or

- all lease payments are variable and not dependent on an index or rate (eg, all lease payments vary based on sales or usage).

The interest rate implicit in the lease may be similar to the lessee’s incremental borrowing rate in many cases. Both rates consider the credit risk of the lessee, the term of the lease, the security and the economic environment in which the transaction occurs.

The interest rate implicit in the lease must be used only if that rate can be readily determined. Sometimes, particularly in relation to leases of real estate, the lessee uses a valuation expert to determine the interest rate implicit in the lease. In our view, rates determined by experts would not qualify as readily determinable and the lessee should be using its incremental borrowing rate instead.

Similarly, where the interest rate implicit in the lease can only be determined by including significant estimates and assumptions, a lessee would likely conclude that the interest rate implicit in the lease is not readily determinable.

Where the lessee is unable to readily determine the interest rate implicit in the lease, the discount rate will be the lessee’s incremental borrowing rate. The incremental borrowing rate is an interest rate specific to the lessee that reflects:

- the credit risk of the lessee

- the term of the lease

- the nature and quality of the security

- the amount ‘borrowed’ by the lessee, and

- the economic environment (the country, the currency and the date that the lease is entered into) in which the transaction occurs

A lessee will need to revise the discount rate when there is a reassessment of the lease liability or a lease modification.

The revised discount rate is the interest rate implicit in the lease for the remainder of the lease term, unless it cannot be readily determined, in which case the lessee’s incremental borrowing rate at the date of reassessment or effective date of lease modification is used.

Transition Choices

There are a significant number of choices available and decisions about these can have a significant impact on the reported balance sheet and income statement. For example, the application of the various transitional provisions could have an impact on:

- your ability to make dividend payments

- tax payments

- your banking covenants

- the attractiveness of employee bonus arrangements

- the availability of investor reliefs

- the metrics your investors use to assess your position and performance.

IFRS 16 provides two methods for first time application of the Standard:

Full Retrospective Method

If the full retrospective approach is taken, the liability and asset are measured as if IFRS 16 had been applied since the start of the lease. There are no further transition reliefs available if this route is taken and full retrospective application in accordance with IAS 8 ‘Accounting Policies, Estimates and Errors’ is required. Comparatives also need to be restated.

Modified Retrospective Method

The cumulative effect of adopting IFRS 16 is recognised in equity as an adjustment to the opening balance of retained earnings for the current period. Prior periods are not restated. This will result in the current and prior periods not being comparable, therefore consideration should be given to how this is explained to the users in the financial statements.

Under the modified retrospective approach, for leases previously classified as operating leases, the lease liability is measured at the present value of the remaining lease payments and discounted using the incremental borrowing rate at the date of initial application. The right-of-use asset can be measured at:

- an amount equal to the lease liability, adjusted by prepayments or accrued lease payments relating to that lease at the date of initial application; or

- the asset’s carrying value as if the Standard had been applied since the commencement date of the lease. Although the carrying value is determined from the commencement of the lease, it is discounted using the lessee’s incremental borrowing rate at the date of initial application.

Using the first of these approaches to measuring the right-of-use asset will be the more straightforward option. However, in many situations, it will result in a higher asset value on transition. This means higher depreciation charges recognised on the right-of-use asset and, more importantly, lower net income in the periods following adoption.

Presentation and disclosure

IFRS 16 requires lessees and lessors to provide information about leasing activities within their financial statements. The Standard explains how this information should be presented on the face of the statements and what disclosures are required. When it comes to the notes, the Standard tends to focus on the details of the information to be provided, leaving it to preparers to decide on the most meaningful way to present it.

Presentation

For a lessee, a lease that is accounted for under IFRS 16 results in the recognition of:

- A right-of-use asset and lease liability;

- Interest expense (on the lease liability); and

- Depreciation expense (on the right-of-use asset)

For a lessor, the requirements are largely the same as IAS 17’s:

- For finance leases the net investment is presented on the balance sheet as a receivable, and

- Assets subject to operating leases continue to be presented according to the nature of the underlying asset.

Disclosures

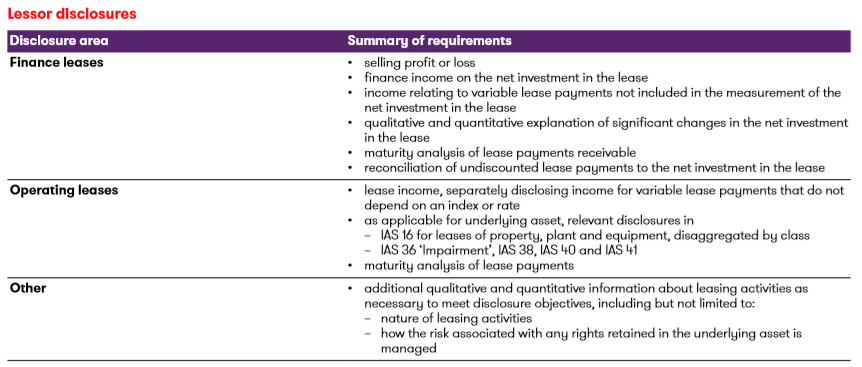

IFRS 16 requires different and more extensive disclosures about leasing activities than IAS 17. The objective of the disclosures is to provide users of financial statements with a basis to assess the effect of leasing activities on the entity’s financial position, performance and cash flows. To achieve that objective, lessees and lessors disclose both qualitative and quantitative information. For lessees, this information is required to be presented in a single note or as a separate section of the financial statements. Information already included in other notes need not be repeated as long as it is appropriately cross-referenced.

Interim periods

The application of IFRS 16 to those interim periods will broadly follow the requirements of IFRS 16 except in one key respect. IFRS 16 requires a variable lease payment, provided it is not in-substance fixed or based on an index or rate, to be recognised in profit or loss in the period in which the triggering event or condition occurs. Therefore, you might assume that the same would apply in interim periods. In other words, a variable lease payment would only be recognised in the interim period in which the event that crystallises the payment occurs.

However, IAS 34.B7 requires a variable lease payment to be recognised if it is expected that the event will occur before the end of the current annual reporting period. This appears to be a direct conflict between the two Standards. In our view, when preparing a set of interim financial statements under IAS 34, the IAS 34 approach should be taken to ensure the interim financial statements are compliant with IAS 34. However, given the evident conflict, it is not possible to entirely rule out an IFRS 16 approach.

Sale and leaseback accounting

IFRS 16 makes significant changes to sale and leaseback accounting. A sale and leaseback transaction is one where an entity (the seller-lessee) transfers an asset to another entity (the buyer-lessor) for consideration and leases that asset back from the buyer-lessor.

When a seller-lessee has undertaken a sale and lease back transaction with a buyer-lessor, both the seller-lessee and the buyer-lessor must first determine whether the transfer qualifies as a sale. This determination is based on the requirements for satisfying a performance obligation in IFRS 15 ‘Revenue from Contracts with Customers’. The accounting treatment will vary depending on whether or not the transfer qualifies as a sale.

Transfer of the asset is a sale

If the transfer qualifies as a sale and the transaction is on market terms the seller-lessee effectively splits the previous carrying amount of the underlying asset into:

- A right-of-use asset arising from the leaseback, and

- The rights in the underlying asset are retained by the buyer-lessor at the end of the leaseback.

The seller-lessee recognises a portion of the total gain or loss on the sale. The amount recognised is calculated by splitting the total gain or loss into:

- An unrecognised amount relating to the rights retained by the seller-lessee, and

- A recognised amount relating to the buyer-lessor’s rights in the underlying asset at the end of the leaseback.

The leaseback itself is then accounted for under the lessee accounting model.

Transfer of the asset is not a sale

If the transfer does not qualify as a sale the parties account for it as a financing transaction. This means that:

The seller-lessee continues to recognise the asset on its balance sheet as there is no sale. The seller-lessee accounts for proceeds from the sale and leaseback as a financial liability in accordance with IFRS 9. This arrangement is similar to a loan secured over the underlying asset – in other words, a financing transaction.

The buyer-lessor has not purchased the underlying asset and therefore does not recognise the transferred asset on its balance sheet. Instead, the buyer-lessor accounts for the amounts paid to the seller-lessee as a financial asset in accordance with IFRS 9. From the perspective of the buyer-lessor, this arrangement is a financing transaction.